1

Create a Mylo account and link your bank to the app.

2

Use your debit and credit cards to make purchases as usual.

3

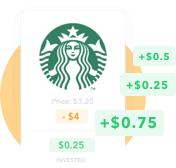

We round your purchases up to the nearest dollar and invest the spare change.

Automatic roundups make investing effortless.

Deposit or withdraw money whenever you want for free.

Saving for a vacation? Paying down debt? Buying a house? With multiple goals, you can do it all.

We use Modern Portfolio Theory to invest in low-cost, exchange-traded funds (ETFs).

One-time boosts & roundup multipliers let you save and invest money at the pace that suits you.

Your dedicated portfolio manager will invest according to your financial goals and profile. And you can speak with them directly if you want to know more about your investments.

If you need help using Mylo we’re here. Our friendly customer success team is on call to answer any questions you might have. All you have to do is reach out directly in the app.

“The app is so simple to use and after a month, I’ve already saved so much money.”

“It’s a sneaky way to save. It also allows for you to do boosts if you want.”

“I love Mylo. It’s such a painless way to invest and your account adds up quickly.”

We’re not a bank, but we use the same measures as major Canadian banks to protect your money, including 256-bit encryption and secure SSL connections.

Your money is invested by an experienced portfolio manager from Tactex Asset Management, a Mylo company that manages over $120 million in assets.

We will never sell your information. Our Privacy Policy was developed by a former Canadian Privacy Commissioner and ensures your information stays personal.

Backed by sophisticated investors including Desjardins Capital, the venture capital fund for the largest association of credit unions in North America.

It only takes a few minutes to take that first step towards achieving your financial goals.

Get Started